The last container ship in Ukraine arrived on the eve of Russia’s invasion and hasn’t moved in 12 days, its crew and cargo safe but caught in a war zone.

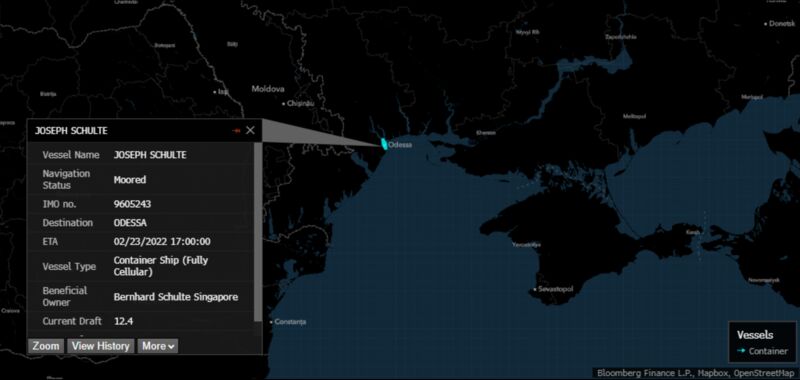

The Joseph Schulte, capable of carrying 9,400 20-foot containers, was still moored in the historic port city of Odesa as of early Monday, according to ship-tracking data compiled by Bloomberg. It has been there since Feb. 23 after entering the Black Sea on Feb. 20, with a stop at a Romanian port in between, the data showed.

The seafarers and ship are “safe and well,” according to a statement from a crisis PR agency that responded to an email request sent directly to Bernhard Schulte, a company in Hamburg, Germany, that controls a fleet of 90 and is listed as the ship’s owner.

The company is “monitoring the situation closely and we remain in constant contact with the crew,” the statement said. Bernhard Schulte “is doing all it can to secure the crew’s safety.”

The agency declined to elaborate when asked if the crew was still in control of the ship.

The vessel, operated by China’s state-run Cosco Shipping, is part of a service called the “Bosphorus Express” that sails a loop between South Korea and the Black Sea, with stops in China, Singapore, Beirut and Tripoli.

Unlike other major container lines, Cosco hasn’t publicly stated that it’s halting bookings for Russian cargo.

France’s CMA CGM, as an Ocean Alliance partner with Cosco, offered its customers shipping services on the route before it suspended bookings of Ukrainian and Russian cargo last week. CMA CGM referred questions to Cosco, which didn’t return an email request for comment.

The ship’s predicament offers a stark example of the turmoil that’s roiling the ocean freight industry and its workers, as the fallout from Russia’s invasion adds disruptions, risks and costs to global trade.

The Kiel Institute for the World Economy, a German think tank, said in a report Monday that “Ukraine is largely cut off from international maritime trade” and that the war is already hurting cross-border commerce in major economies such as the U.S. and Germany.

Check out more of Bloomberg’s Russia-Ukraine coverage:

- Supply chains are unleashing another shock as efforts to choke off trade with Russia strain resources ranging from fertilizer to palladium.

- About 140 ships have been trapped off the coast of Ukraine, putting more than a thousand seafarers in harm’s way.

- Dock workers around the world are pushing to widen bans on Russian ships from their ports.

- Russian armored personnel carriers are stalled by the roadside for lack of fuel. Soldiers forage for food in grocery stores. Trucks are backed up from Kyiv in what looks like a failure of logistics.

—Brendan Murray in London

Charted Territory

Flight Diversions. The attack on Ukraine has upended decades of ever-closer alliances in commercial aviation. After the U.K. barred Aeroflot and other Russian carriers from entering its airspace late last month and the European Union introduced sweeping sanctions, Russia retaliated, banning virtually every country in Europe — including historically neutral Switzerland — from its airspace. The U.S. swiftly followed suit, closing its airspace to Russia. (Click here for the full story.)

Today’s Must Reads

- More stable growth | China’s export growth moderated in the first two months of the year, pointing to more stable global demand as multiple risks cloud the outlook. Separately, Beijing set an ambitious economic growth target for the year, putting the spotlight back on fiscal stimulus.

- Tariff review | The Biden administration will soon start a review of the first group of tariffs on more than $300 billion in Chinese imports needed to prevent their expiration. Meanwhile, China’s goal to achieve around 5.5% economic growth this year is a challenging one, economists say.

- Out of favor | The European Union is seeking to remove Russia’s most-favored nation status at the World Trade Organization, a move that could further hit 95 billion euros of Moscow’s exports to the bloc with tariffs. Meanwhile, the U.S. is examining its options at the Geneva-based trade body.

- Chips woes | Toshiba said supply challenges for electronic components are unlikely to abate for another year as chronic shortages remain, and the Russia-Ukraine way may also have an impact.

- Commodity rally | Russia’s invasion has sparked a feverish run-up in the prices of just about every commodity — from oil to grains to metals. Oil soared in Asia near $130 a barrel on Monday.

- Energy spike | Singapore said that the impact of the war in Ukraine will be “significant” over time as it disrupts global supply chains and energy costs, according to Minister for Trade and Industry Gan Kim Yong.

On the Bloomberg Terminal

- Impact on Asia | Asia’s supply chains have yet to heal, and the commodity-price jolt triggered by Russia’s war on Ukraine is likely to make matters worse, according to Bloomberg Economics.

- Chemical reaction | Spiking energy prices are setting up a return to hikes in petrochemicals, after some had eased in late 2021, Bloomberg Intelligence says.

- Use the AHOY function to track global commodities trade flows.

- Click HERE for automated stories about supply chains.

- See BNEF for BloombergNEF’s analysis of clean energy, advanced transport, digital industry, innovative materials, and commodities.

- Click VRUS on the terminal for news and data on the coronavirus and here for maps and charts.

Like Supply Lines?

Don’t keep it to yourself. Colleagues and friends can sign up here. We also publish the New Economy Daily, a briefing on the latest in global economics.

For even more: Follow @economics on Twitter and subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters.

How are we doing? We want to hear what you think about this newsletter. Let our trade tsar know.